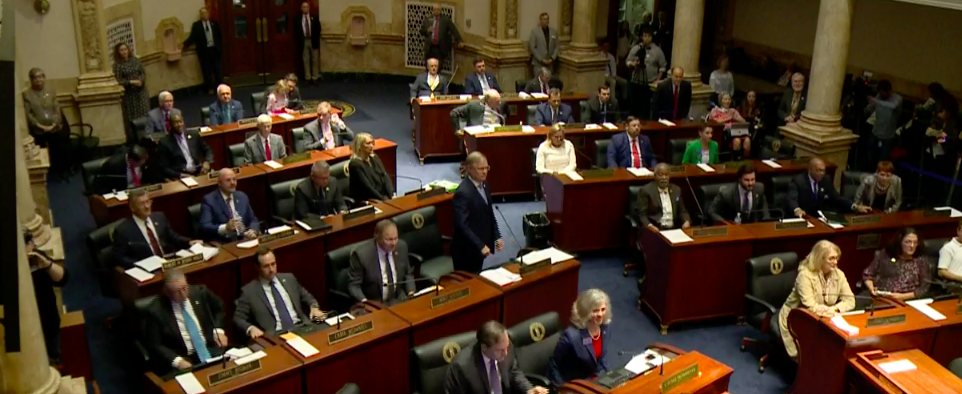

Days after the state income tax was lowered to 4.5 percent Republicans in the Kentucky legislature have sent another legislative drop to the tax to Democratic Gov. Andy Beshear.

“I am excited to see another income tax reduction measure reach the Governor’s desk,” Sen. Chris McDaniel said. “The onus is now on Governor Andy Beshear to show if he does, or does not, stand with working Kentucky taxpayers. No matter his position, the Kentucky General Assembly stands ready to override his gubernatorial veto.”

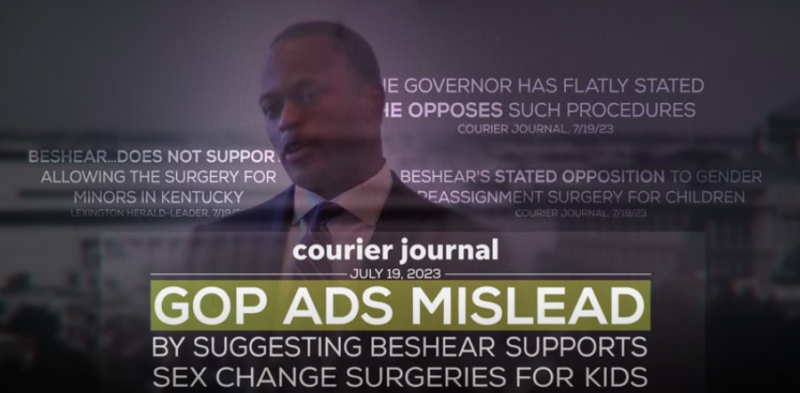

The legislation comes as Beshear seeks re-election, and a dozen Republicans fight for the nomination to challenge him this fall.

House Bill 1, represents the “next step in the Kentucky General Assembly’s efforts to eliminate the individual income tax entirely.”

In 2018, the General Assembly decreased the individual income tax rate from 6% to 5%. During the 2022 Regular Session, lawmakers passed HB 8, which laid the groundwork to eliminate the individual income tax entirely but includes preset triggers that must be met before the legislature can move to decrease the tax in half a percentage point increments.

“These tax cuts are the result of responsible budgeting and a commitment to the philosophy that these are taxpayer dollars to begin with and state government is merely the trustee of those resources,” added Appropriations and Revenue Chair Jason Petrie, who also sponsored HB 8 in the 2022 Regular Session. “They also represent an end to the practice of penalizing productivity and will make our state more competitive for not only jobs, but individuals who are ready and willing to join our workforce.”

Login

Login  Must include at least 8 charaters

Must include at least 8 charaters