Op-ed from Republican candidate for Governor and Kentucky Agriculture Commissioner Ryan Quarles.

“Kentucky is one of only six states that still has an inheritance tax. Coal severance tax receipts are declining because of the Obama-Biden war on coal. And income tax rates undermine Kentucky’s competitiveness. I’ve got a Kentucky Commonsense Plan to fix all of this.”

What your government does with taxation can tell you a lot about your elected officials’ priorities and your state’s economic competitiveness. Does your government collect taxes that punish hard work? Does it use tax revenues for the purposes they are intended to serve? Does it continue to collect taxes that are irrational and unfair?

In my time as Agriculture Commissioner, I’ve focused on being a good steward of Kentuckians’ hard-earned money. We’ve cut our budget five times and reduced our workforce to half the number of employees we had 20 years ago, all while improving our efficiency in serving the people of Kentucky.

Kentucky needs that kind of thinking in the Governor’s Office and that’s why I’m adding three agenda items to my Kentucky Commonsense Plan: ending the death tax, guaranteeing that 100% of coal severance tax revenues will be returned to coal-producing counties instead of being diverted to other purposes, and ending the state income tax once and for all.

Final repeal of Kentucky’s Death Tax. Did you know that Kentucky is one of only six states in the nation that still has an inheritance tax, better known as the Death Tax? For the families that feel the impact of Kentucky’s Death Tax, its impact can be devastating. Having to scrape together a sum of money equal to 16% of the value of the inherited assets could prove impossible for family members who are struggling to keep the business afloat in a time of heavy personal grief. We need to end the Death Tax to prevent family-owned businesses from losing their legacy and losing jobs.

The numbers show that the devastation is real. In 2021, the Kentucky Department of Revenue collected more than $60,000,000 in Death Tax payments. Those tens of millions of dollars are more than just numbers in a chart; they represent lost opportunities for keeping a family farm’s acreage intact, for expanding a family business, and for passing on a legacy to future generations. We need to end the Death Tax to keep money in the hands of families who will carry on the legacies of their loved ones. In my first year as Governor, I will urge the General Assembly to abolish Kentucky’s Death Tax once and for all. Imagine losing a family-owned business due to state taxes. We need to end the Death Tax to prevent family-owned businesses from losing their legacy and losing jobs.

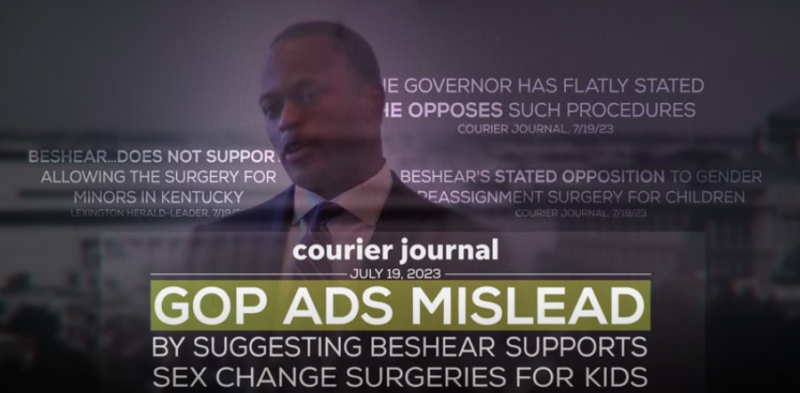

Honest Dealing with Coal Severance Tax Revenues. The Obama-Biden assault on fossil fuels has done exactly what Hillary Clinton said it would: it’s put a lot of miners out of work. Given the decline in revenues, I promise that as your Governor, my budget proposals will call for 100% of coal severance tax revenues be returned to coal producing counties instead of being diverted to other purposes like when Steve Beshear was caught spends millions of dollars in coal severance taxes that did not benefit the counties that they were collected from. Our coal miners and their families deserve better than that.

Income tax elimination. With Republican majorities in charge for the last six years, the General Assembly’s stewardship of our taxpayer dollars has been a head-and-shoulders improvement over the decades of Democratic mismanagement that left Kentucky with one of the worst pension deficits in the nation. Under Republican leadership, state revenues have grown to the point that our rainy-day fund is healthier than ever and the Beshear Family Pension Shortfall is on course to being fixed. At the same time, Republican legislators have steered Kentucky onto a course of gradual income tax rate reductions which will eventually eliminate the state income tax. I will help reach that goal by working with the legislature to eliminate the income tax in a responsible way. I’ll be a Governor that legislators can work with, not one who sues them all the time.

Years ago the General Assembly took partial steps to limit the impact of Kentucky’s Death Tax. Now it’s time to finish the job. It’s time to stop playing games with coal severance funds and return them to where they came. Even today, income tax rates remain too high. When I am Governor, I will fix these problems and make Kentucky a more prosperous place for all.

Login

Login  Must include at least 8 charaters

Must include at least 8 charaters